PROTECTED SOURCE SCRIPT

업데이트됨 IC Swing - V1

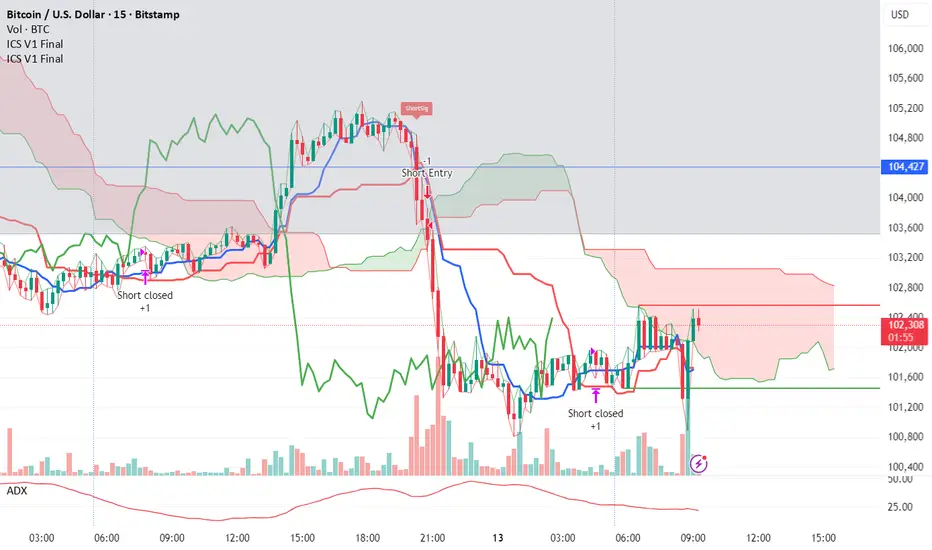

The core goal of the script is to capture trades that align with a strong trend confirmed by the Ichimoku Cloud and ADX/DMI, with entries based on a Kijun-Tenkan cross and exits managed by dynamic swing pivot-based trailing stops.

Position Management & Exit Logic

The strategy uses a robust, two-part system to manage risk and lock in profits:

Initial Stop Loss (SL): An immediate, hard stop-loss is placed when a trade opens, calculated as the ATR Multiplier (default 2.0) away from the entry bar's low (for long) or high (for short). This provides instant protection.

Trailing Stop: After a configurable delay (minBarsBeforeExit, default 2 bars), the initial stop-loss is overwritten by a dynamic trailing stop. This stop is based on the last confirmed swing pivot (low for long, high for short), buffered by a small ATR amount (0.5). The stop only trails in the direction of the trade (e.g., moves up for a long trade) and never moves against it.

Hard Exit (Swing Break): The position is closed if the price breaks the last confirmed swing pivot against the trade direction, acting as a second, swing-based exit mechanism.

Latching Exits: The exitLatchLong/exitLatchShort variables are used to prevent the strategy from immediately reversing or re-entering on the same bar after a position has been closed due to a stop hit or a hard exit.

Position Management & Exit Logic

The strategy uses a robust, two-part system to manage risk and lock in profits:

Initial Stop Loss (SL): An immediate, hard stop-loss is placed when a trade opens, calculated as the ATR Multiplier (default 2.0) away from the entry bar's low (for long) or high (for short). This provides instant protection.

Trailing Stop: After a configurable delay (minBarsBeforeExit, default 2 bars), the initial stop-loss is overwritten by a dynamic trailing stop. This stop is based on the last confirmed swing pivot (low for long, high for short), buffered by a small ATR amount (0.5). The stop only trails in the direction of the trade (e.g., moves up for a long trade) and never moves against it.

Hard Exit (Swing Break): The position is closed if the price breaks the last confirmed swing pivot against the trade direction, acting as a second, swing-based exit mechanism.

Latching Exits: The exitLatchLong/exitLatchShort variables are used to prevent the strategy from immediately reversing or re-entering on the same bar after a position has been closed due to a stop hit or a hard exit.

릴리즈 노트

Bot alerts - fixed릴리즈 노트

Alerts - fixed릴리즈 노트

Alert fixed릴리즈 노트

Alert릴리즈 노트

alert보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

보호된 스크립트입니다

이 스크립트는 비공개 소스로 게시됩니다. 하지만 이를 자유롭게 제한 없이 사용할 수 있습니다 – 자세한 내용은 여기에서 확인하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.