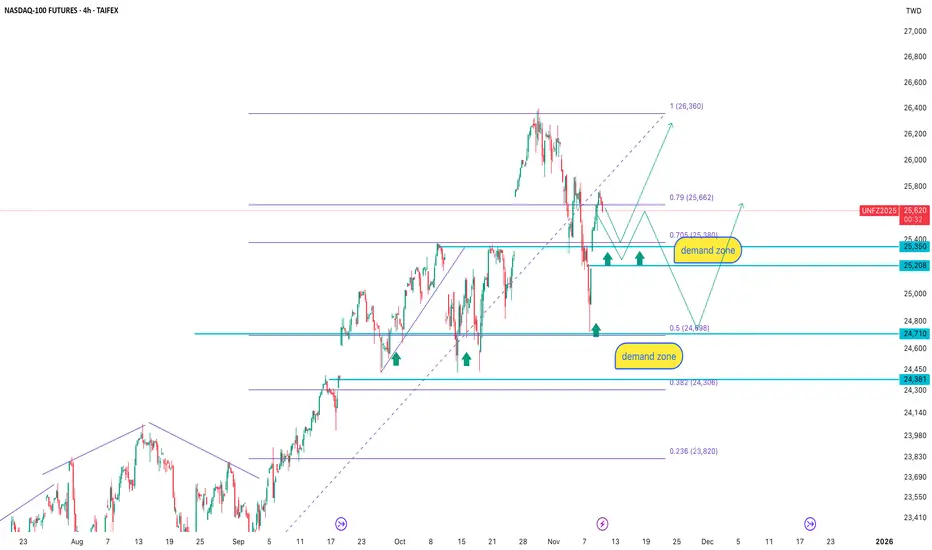

After the recent upward impulse, the price retraced into the key demand zone at 25 350–25 208, an area that has repeatedly triggered buying reactions in the past. T

he latest correction pushed the price into the 0.79–0.705 Fibonacci range, which frequently acts as a retest zone before continuation.

Below that lies an even stronger demand zone at 24 710–24 381, aligning with the 0.5 Fibonacci level and previous volume accumulation.

The trading logic here is simple: don’t chase the move, let the price come to demand and wait for confirmation.

As long as the market structure holds, the primary scenario remains bullish from demand zones with a target toward 26 360 and potentially higher.

Fundamentally, NASDAQ remains supported by expectations of softer Fed policy, strong tech capital inflows, and continued investment in AI, cloud, and data-center infrastructure. Smart money accumulates on corrections, not on peaks.

When price falls into demand, it’s not fear — it’s opportunity.

he latest correction pushed the price into the 0.79–0.705 Fibonacci range, which frequently acts as a retest zone before continuation.

Below that lies an even stronger demand zone at 24 710–24 381, aligning with the 0.5 Fibonacci level and previous volume accumulation.

The trading logic here is simple: don’t chase the move, let the price come to demand and wait for confirmation.

As long as the market structure holds, the primary scenario remains bullish from demand zones with a target toward 26 360 and potentially higher.

Fundamentally, NASDAQ remains supported by expectations of softer Fed policy, strong tech capital inflows, and continued investment in AI, cloud, and data-center infrastructure. Smart money accumulates on corrections, not on peaks.

When price falls into demand, it’s not fear — it’s opportunity.

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

🔗 Сайт totoshkatrades.com

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.