🧠 Nifty Elliott Wave Analysis | Accurate Highs & Bottoms Predicted | Next Move Explained

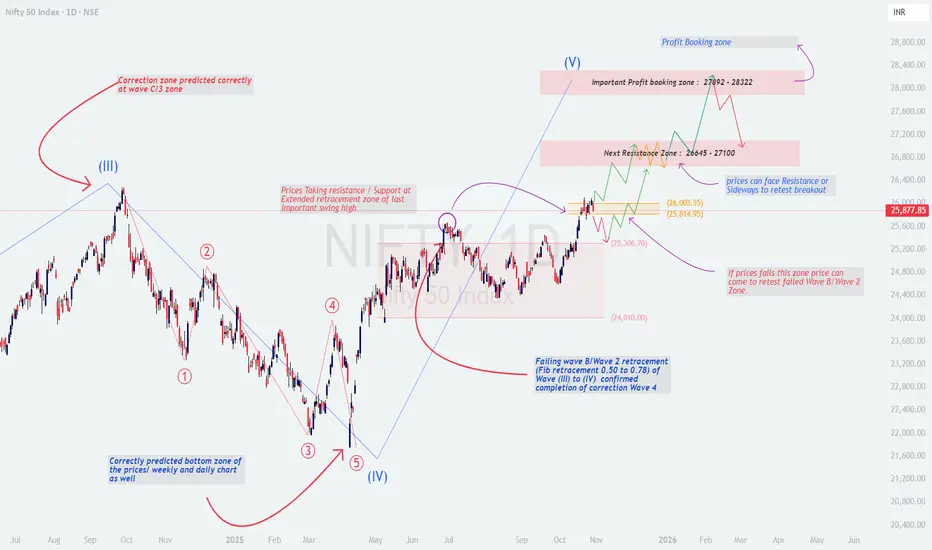

I had accurately predicted both the top (Wave III) and the bottom (Wave IV) of the Nifty move — as seen in the attached chart 📈

The corrective zone at Wave C / 3 and the final retracement completion around Wave 4 were both identified in advance, confirming the accuracy of our earlier projection.

🔍 Current Technical Outlook

Nifty has completed its Wave (IV) correction and is now attempting to form an impulsive Wave (V) move.

Price is currently trading around 25,880, taking resistance near the extended retracement zone of the previous swing high.

If this level is crossed and sustained, the next upside momentum can unfold in multiple stages as shown below.

📈 Upside Projections

Next Resistance Zone: 26,645 – 27,100

🔸 Price may slow down or move sideways to retest the breakout here.

Major Profit Booking Zone: 27,892 – 28,322

🔸 This is a key Fibonacci extension and Wave (V) target area where partial booking is advised.

⚙️ Support & Risk Levels

Immediate Support: 25,814 – 26,000

Major Support: 25,306

Critical Support / Reconfirmation Zone: 24,010 (Failed Wave B / Wave 2 zone)

📉 If prices fail to hold 25,800–25,300, we may see a retest toward 24,000–24,200, which would only delay but not invalidate the long-term bullish structure.

🧭 Expected Price Behaviour

As long as Nifty stays above 25,300, the Wave (V) uptrend remains intact.

Prices can show sideways consolidation or retest near the breakout before pushing higher.

Any strong breakout above 26,650–27,100 can open the gate for 28,000+ targets.

⚠️ Keep Watch & Stay Cautious

Watch for rejection candles or low-volume breakouts near 26,600–27,000 zone.

Stay alert for profit booking or reversal signals near 27,800+.

Ideal approach: Buy on dips, book partial profits near resistance, trail stop-loss.

📅 Posted on: 30 Oct 2025

I had accurately predicted both the top (Wave III) and the bottom (Wave IV) of the Nifty move — as seen in the attached chart 📈

The corrective zone at Wave C / 3 and the final retracement completion around Wave 4 were both identified in advance, confirming the accuracy of our earlier projection.

🔍 Current Technical Outlook

Nifty has completed its Wave (IV) correction and is now attempting to form an impulsive Wave (V) move.

Price is currently trading around 25,880, taking resistance near the extended retracement zone of the previous swing high.

If this level is crossed and sustained, the next upside momentum can unfold in multiple stages as shown below.

📈 Upside Projections

Next Resistance Zone: 26,645 – 27,100

🔸 Price may slow down or move sideways to retest the breakout here.

Major Profit Booking Zone: 27,892 – 28,322

🔸 This is a key Fibonacci extension and Wave (V) target area where partial booking is advised.

⚙️ Support & Risk Levels

Immediate Support: 25,814 – 26,000

Major Support: 25,306

Critical Support / Reconfirmation Zone: 24,010 (Failed Wave B / Wave 2 zone)

📉 If prices fail to hold 25,800–25,300, we may see a retest toward 24,000–24,200, which would only delay but not invalidate the long-term bullish structure.

🧭 Expected Price Behaviour

As long as Nifty stays above 25,300, the Wave (V) uptrend remains intact.

Prices can show sideways consolidation or retest near the breakout before pushing higher.

Any strong breakout above 26,650–27,100 can open the gate for 28,000+ targets.

⚠️ Keep Watch & Stay Cautious

Watch for rejection candles or low-volume breakouts near 26,600–27,000 zone.

Stay alert for profit booking or reversal signals near 27,800+.

Ideal approach: Buy on dips, book partial profits near resistance, trail stop-loss.

📅 Posted on: 30 Oct 2025

액티브 트레이드

NIFTY has been moving exactly in line with my predictions so far — and now, a fresh NEW HIGH looks well within reach.면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.