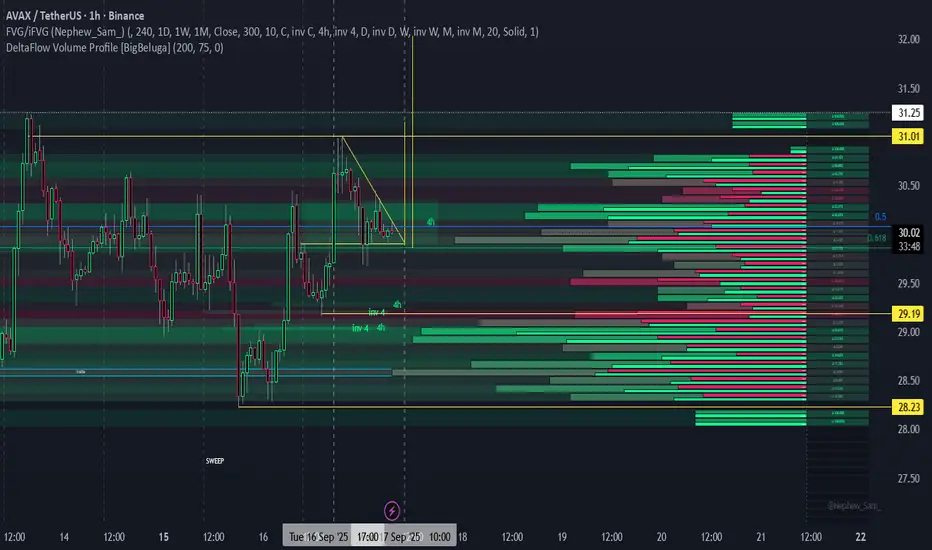

AVAX is printing a classic cup & handle structure on the 1H. The “cup” is formed by the rounded bottom near $27–28, while the “handle” is tightening just below the $30 HVN shelf.

🔹 Volume Profile Read:

The HVN zone sits right at $30, which explains the current stall. This is a key decision area — acceptance here fuels continuation, rejection sends us back into lower volume.

LVN gap above $30.4 → $31.2 offers a clean path for price discovery. If bulls push through, the lack of volume in this zone should let price glide quickly.

Below, the support HVN around $29–29.2 is acting as the handle base and accumulation shelf.

🔹 Delta Flow Insight:

Buyer delta is slowly absorbing sell pressure on the handle retrace, suggesting smart money is building position under resistance.

Sellers are failing to expand below the HVN shelf — classic “handle shakeout” behavior.

What the 4H FVG is saying

The FVG is sitting right inside the handle consolidation zone, basically overlapping with that $29.5–30 HVN shelf.

That means price dipped, left inefficiency, and now we’re seeing consolidation/absorption right on top of it.

🔹 Confluence with Volume Profile

HVN at $29.5–29.8 = strong acceptance zone.

4H FVG below = unfilled imbalance that smart money often defends.

Together, this says: “If the handle holds, this FVG becomes the launchpad.”

🔹 Trading Implication

If price respects the top of the 4H FVG and stays bid → bullish continuation signal.

If it trades deep through the bottom of the FVG and closes below → invalidates the setup, shifts bias bearish.

📈 Trading Bias:

Break and hold above $30.4 = bullish continuation into $31.2 / $32 LVN.

Failure to hold $29.8 HVN = reversion back into $29 support shelf.

⚠️ Invalidation: A strong acceptance below $29 would void the cup & handle structure and shift bias back to bearish.

🔹 Volume Profile Read:

The HVN zone sits right at $30, which explains the current stall. This is a key decision area — acceptance here fuels continuation, rejection sends us back into lower volume.

LVN gap above $30.4 → $31.2 offers a clean path for price discovery. If bulls push through, the lack of volume in this zone should let price glide quickly.

Below, the support HVN around $29–29.2 is acting as the handle base and accumulation shelf.

🔹 Delta Flow Insight:

Buyer delta is slowly absorbing sell pressure on the handle retrace, suggesting smart money is building position under resistance.

Sellers are failing to expand below the HVN shelf — classic “handle shakeout” behavior.

What the 4H FVG is saying

The FVG is sitting right inside the handle consolidation zone, basically overlapping with that $29.5–30 HVN shelf.

That means price dipped, left inefficiency, and now we’re seeing consolidation/absorption right on top of it.

🔹 Confluence with Volume Profile

HVN at $29.5–29.8 = strong acceptance zone.

4H FVG below = unfilled imbalance that smart money often defends.

Together, this says: “If the handle holds, this FVG becomes the launchpad.”

🔹 Trading Implication

If price respects the top of the 4H FVG and stays bid → bullish continuation signal.

If it trades deep through the bottom of the FVG and closes below → invalidates the setup, shifts bias bearish.

📈 Trading Bias:

Break and hold above $30.4 = bullish continuation into $31.2 / $32 LVN.

Failure to hold $29.8 HVN = reversion back into $29 support shelf.

⚠️ Invalidation: A strong acceptance below $29 would void the cup & handle structure and shift bias back to bearish.

거래청산: 스탑 닿음

Failed.노트

WHOOSH! Excellent.면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.