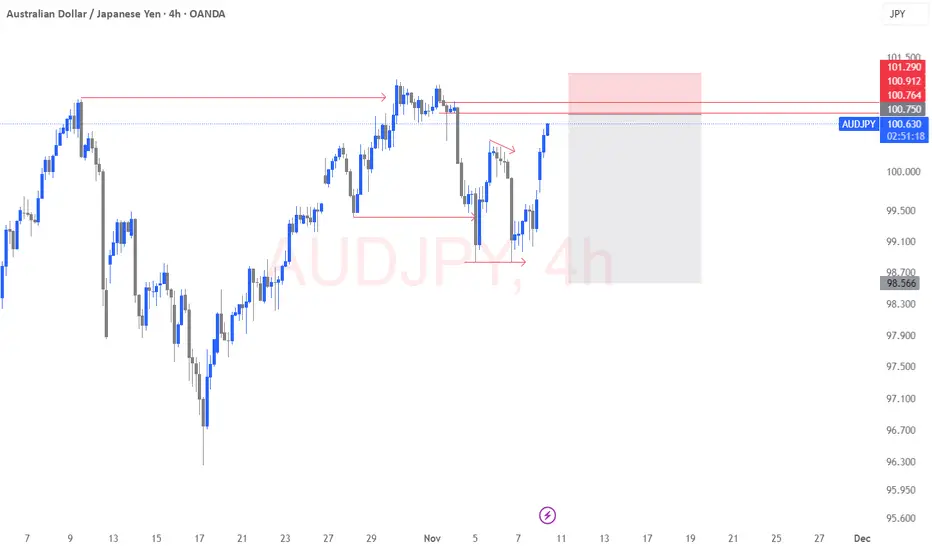

AUDJPY is retracing into a key 4H supply zone, the origin of the last major sell-off.

The current push upward is corrective and liquidity-driven not impulsive buying. This is the classic behaviour you see before distribution.

We’ve already seen:

• A sweep of the previous high (liquidity grab)

• A clean break of structure to the downside

• A measured pullback into premium pricing

All of this positions AUDJPY for a potential short, but only with confirmation.

Execution Criteria (Where the edge lives)

Once price taps deeper into the 4H supply:

Look for M15/M5 confirmations:

• Bearish BOS

• Strong displacement

• Fresh LTF supply for refined entry

Yen pairs often sweep the extreme before reversing, stay disciplined.

Downside Outlook

If sellers engage, the first target sits around 98.50–98.70, with room for deeper continuation as structure unfolds.

Summary

AUDJPY is entering a high-value 4H supply zone with a strong structural case for a short continuation. The corrective rally sets up the narrative, but we only execute once the lower timeframes validate the shift.

Do you see this zone holding for a short or breaking higher? Drop your bias below 👇

And if you enjoy clean, institutional-grade analysis,

👉 Follow my profile here on TradingView for more setups.

#AUDJPY #Forex #FX #PriceAction #TechnicalAnalysis #SmartMoney #Liquidity #4H #SupplyDemand #MarketStructure #SwingTrading #JapaneseYen #OrderFlow #Imbalance

The current push upward is corrective and liquidity-driven not impulsive buying. This is the classic behaviour you see before distribution.

We’ve already seen:

• A sweep of the previous high (liquidity grab)

• A clean break of structure to the downside

• A measured pullback into premium pricing

All of this positions AUDJPY for a potential short, but only with confirmation.

Execution Criteria (Where the edge lives)

Once price taps deeper into the 4H supply:

Look for M15/M5 confirmations:

• Bearish BOS

• Strong displacement

• Fresh LTF supply for refined entry

Yen pairs often sweep the extreme before reversing, stay disciplined.

Downside Outlook

If sellers engage, the first target sits around 98.50–98.70, with room for deeper continuation as structure unfolds.

Summary

AUDJPY is entering a high-value 4H supply zone with a strong structural case for a short continuation. The corrective rally sets up the narrative, but we only execute once the lower timeframes validate the shift.

Do you see this zone holding for a short or breaking higher? Drop your bias below 👇

And if you enjoy clean, institutional-grade analysis,

👉 Follow my profile here on TradingView for more setups.

#AUDJPY #Forex #FX #PriceAction #TechnicalAnalysis #SmartMoney #Liquidity #4H #SupplyDemand #MarketStructure #SwingTrading #JapaneseYen #OrderFlow #Imbalance

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.