- Adobe reversed from support area

- Likely to rise to resistance level 350.00

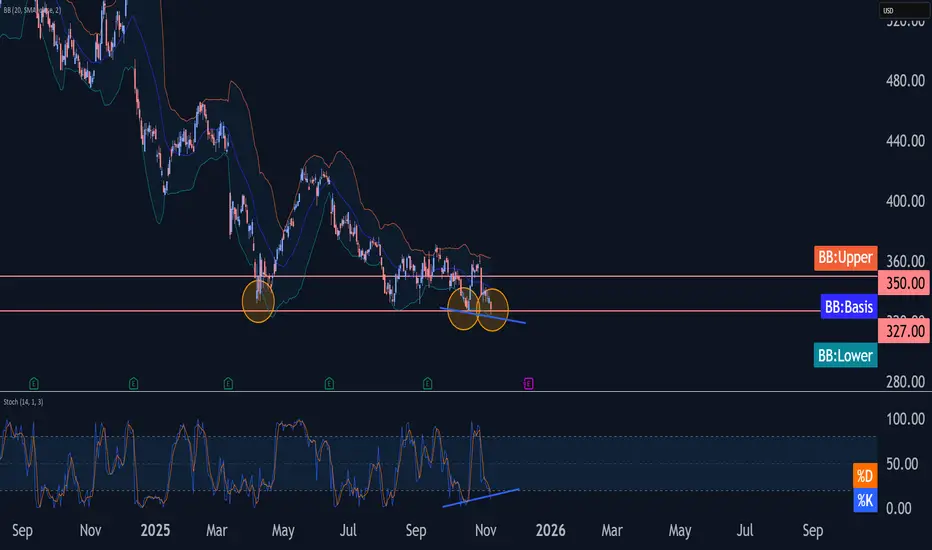

Adobe recently reversed from the support area surrounding the key support level 327.00 (which has been reversing the price from April) – strengthened by the lower daily Bollinger Band.

The upward reversal from the support area formed the daily Japanese candlesticks reversal pattern Hammer, which stopped the earlier ABC correction (ii) from the end of October.

Given the strength of the support level 327.00 the bullish divergence on the daily Stochastic indicator, Adobe can be expected to rise to the next resistance level 350.00.

- Likely to rise to resistance level 350.00

Adobe recently reversed from the support area surrounding the key support level 327.00 (which has been reversing the price from April) – strengthened by the lower daily Bollinger Band.

The upward reversal from the support area formed the daily Japanese candlesticks reversal pattern Hammer, which stopped the earlier ABC correction (ii) from the end of October.

Given the strength of the support level 327.00 the bullish divergence on the daily Stochastic indicator, Adobe can be expected to rise to the next resistance level 350.00.

By the FxPro Analyst Team

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.

By the FxPro Analyst Team

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

Follow our dedicated Telegram channel t.me/fxpro for insightful market analysis and expert commentary.

Reach out to media.comments@fxpro.com for PR and media inquiries

면책사항

해당 정보와 게시물은 금융, 투자, 트레이딩 또는 기타 유형의 조언이나 권장 사항으로 간주되지 않으며, 트레이딩뷰에서 제공하거나 보증하는 것이 아닙니다. 자세한 내용은 이용 약관을 참조하세요.